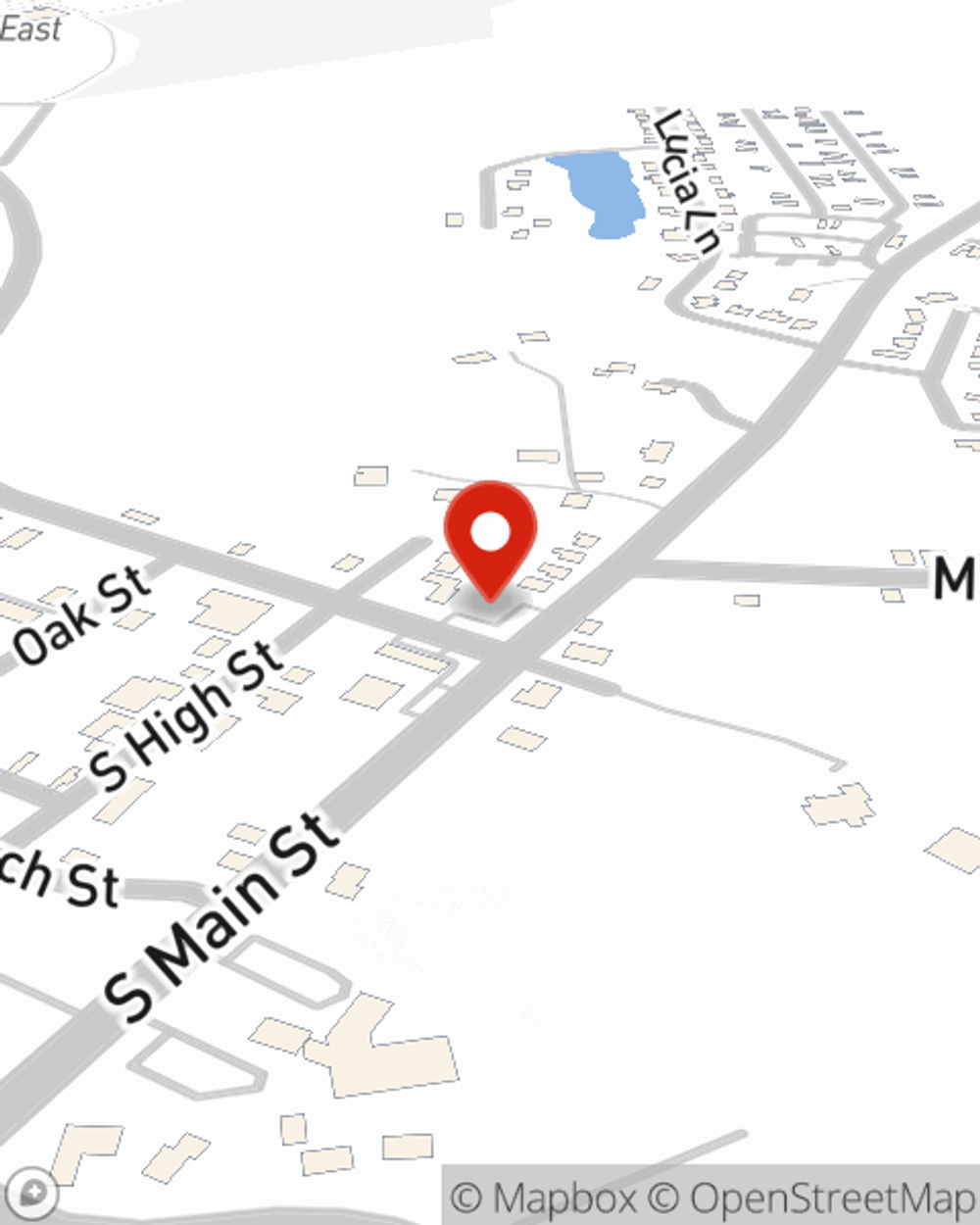

Renters Insurance in and around Shiloh

Your renters insurance search is over, Shiloh

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Scott Air Force Base

- O'Fallon

- Belleville

- Troy

- Mascoutah

- New Baden

- Fairview Heights

- Collinsville

- Edwardsville

- Caseyville

- Lebanon

- Trenton

- Aviston

- Breese

- Freeburg

- Granite City

- Albers

- Carlyle

- East Saint Louis

- Columbia

- Waterloo

- Glen Carbon

- Maryville

- St. Louis

There’s No Place Like Home

Being a renter doesn't mean you are 100% carefree. You want to make sure what you own is protected in the event of some unexpected catastrophe or damage. And you also need liability protection for friends or visitors who might stumble and fall on your property. State Farm Agent Carol Compton-McDonald is ready to help you handle the unexpected with high-quality coverage for your renters insurance needs. Such thoughtful service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If mishaps occur, Carol Compton-McDonald can help you submit your claim. Keep your home in a rental-sweet-rental state with State Farm!

Your renters insurance search is over, Shiloh

Coverage for what's yours, in your rented home

There's No Place Like Home

When the unpredicted tornado happens to your rented condo or apartment, usually it affects your personal belongings, such as a desk, a set of favorite books or a stereo. That's where your renters insurance comes in. State Farm agent Carol Compton-McDonald can help you choose the right policy so that you can insure your precious valuables.

It's always a good idea to make sure you're prepared. Contact State Farm agent Carol Compton-McDonald for help learning more about options for your policy for your rented property.

Have More Questions About Renters Insurance?

Call Carol at (618) 624-5600 or visit our FAQ page.

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Carol Compton-McDonald

State Farm® Insurance AgentSimple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.